Real Estate In Europe

I am not yet a homeowner, but I’m on the brink… and the euro’s weakness against the dollar is coming at a beautiful time for me.

After our recent scouting trip to Cyprus, my husband and I are currently deciding between a couple of our favorite opportunities there. (If you’re interested in the details, we’ll be writing up the most interesting of the offers we found on the ground in our next issue of Global Property Advisor.)

We gave Power of Attorney while we were there, and as soon as we’ve chosen our preferred condo style, we’ll have our attorney there pull the trigger for us.

My husband and I are in our 30s, and we feel like we’re fairly late to the property-buying game… most people we know our age already own or have owned something, somewhere.

We’ve been cautious… but, more than that, undecided. Back in Panama we considered buying a unit in our high-rise on Ave. Balboa… but since we knew we’d leave Panama sooner or later, it was hard to think of leaving our nest egg there—what if we could find something to buy in Paris eventually?

Of course, if we made our first purchase in the States, we could qualify for a very attractive mortgage as first-time buyers… but we could never decide between a pure investment or something we thought we could use on occasion.

If we bought here in France, we could potentially get some use out of a home… but in that case which part of the country do we want to commit to?

Finally, investment in Cyprus won out based on affordability, projected returns, and the fully turnkey management programs… and, boy, am I glad we waited…

It’s generally not wise to try to time an investment for a currency dip—you may sit on the fence forever if you do—but if it happens by chance, take full advantage!

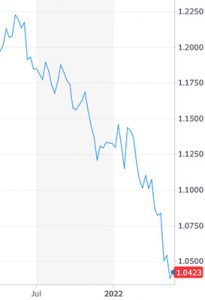

The euro has been dropping in value all year…

Last May the euro was worth US$1.22… this May, it hit its lowest in years at US$1.04.

Today it’s at US$1.08, making European property 11.5% cheaper right now than it was a year ago for U.S. investors.

This is great news for U.S. investors… A significant “dollar discount” is available to us right now.

It won’t last… Since last week, I’ve already lost out on about 4% of potential discount (when it was at US$1.04, the discount was nearly 15%).

This the moment to snap up properties that are sold in euros.

The euro has just about reached the bottom of its crash. It might lose a few more cents before it bottoms out and starts to regain its strength over the coming 6 to 12 months.

When it recovers in value, you’ll get to double down on your gains by adding the foreign exchange gains to any capital appreciation that your property experiences… All while earning rental income in a risk diversified investment.

Benefits Of A Weak Euro For U.S. Dollar Investors

A weak euro is great for buyers spending U.S. dollars.

An American investor who bought a house in Portugal that cost 100,000 euros a year ago would have spent US$122,000. Today, the exact same 100,000-euro investment would cost them US$104,000.

The overall cost of living in Europe has also gone down for U.S. dollar holders. The costs of travel, property inspection tours, and renovation are reduced.

A strong dollar also encourages American tourists to come and rent out your overseas property.

Drawbacks Of A Weak Euro To Foreign Investors

A weak euro is bad for investors who want to sell their eurozone property and convert the proceeds back into U.S. dollars.

This is not the optimal time to sell European property and buy property sold in U.S. dollars, as you’ll lose up to 15% on the current exchange rate.

Your rental income is now less when converted into U.S. dollars. If you are relying on your European investment to pay U.S.-dollar expenses, this affects your cash flow.

Foreign Currency Rental Income And Hedging

A local currency bank account provides a simple hedge against bad exchange rates, as you can choose not to convert your rental income to U.S. dollars when the exchange rate is not favorable.

When the dollar is strong, you can save your euros for later exchange at a better rate or spend them in that country. You can improve your property or double down and buy more property in the depressed market with your saved local currency.

The euro always commands its full buying power in Europe.

If you choose to live abroad, you find yourself somewhat insulated against the effects of currency fluctuation.

When the U.S. dollar is strong, your foreign property will fall in U.S. dollar value but your cost of living will also fall due to a strengthening U.S. dollar and vice versa.

If you bought property in euros last year you could be experiencing real estate appreciation while losing U.S. dollar value temporarily due to depreciation of the local currency.

This capital appreciation can be realized when the euro rebounds, or you can leave it safely diversified abroad if you are happy with the investment.

Currency diversification is about spreading risk.

The risk is that the value of your foreign currency can go down. The reward is that the value of your foreign currency can go up.

But the more diversified you get, the less affected you are by any one event.

Be aware of any foreign exchange controls of your host country before making an overseas investment.

How To Save Thousands On Your Foreign Real Estate Purchase

Don’t go to your bank to exchange currencies, use a reliable foreign exchange intermediary like Moneycorp. It can save you thousands on fees and charges when you’re talking about the cost of a house.

Tax Implications Of Forex Fluctuation

• Expense write-off: Mortgage interest and maintenance expenses of your foreign investment property are tax deductible, but remember when filing that the value must be converted into U.S. dollar values on each transaction date, not the sale date. Ensure you get your full foreign tax credit allocation for any taxes paid abroad.

• Selling a foreign home: If you own a foreign home and have lived there for two of the last five years as your primary residence, you and your spouse can each avail of US$250,000 in tax-free gains.

• Forex losses: Sometimes you are forced to sell your European property when the dollar is strong. If you have to pay off a U.S.-based mortgage with the proceeds, any forex losses realized due to the U.S. dollar strengthening and an increase in the mortgage in foreign currency terms are considered personal losses and are not tax deductible. Forex gains on foreign real estate investments due to forex factors are taxable at ordinary U.S. tax rates. Always get professional tax advice.

• Fixing exchange rates in contracts: It’s common to fix the exchange rates in sales contracts when they are signed as forex changes between the signing date and closing date. This can cause significant additional costs to buyers.

Kat Kalashian

Editor, Live and Invest Overseas: Confidential